China-Backed Hackers Still Lurking in US Telecom Networks, Officials Warn

US government officials reveal that China-backed hacking group Salt Typhoon remains in US telecom networks, sparking concerns over national security and data privacy.

Riley King

Nigeria's banking sector is facing a crisis of confidence as a series of system glitches has led to unauthorized transactions, financial losses, and reputational damage. In recent months, several major banks, including Wema, Keystone, and Union, have experienced significant system failures, resulting in unapproved transfers totaling ₦17.3 billion ($10.7 million) from customers' accounts.

These glitches have not only caused financial losses for individuals but also raised concerns about the security of interbank settlements, particularly in underserved communities where digital banking is the primary means of financial inclusion. The Central Bank of Nigeria's goal of achieving 80% financial inclusion by 2026 is now under threat, as these failures could stall or even reverse progress made so far.

Experts attribute the glitches to unrealistic deadlines set by bank CEOs, which lead to rushed system upgrades and inadequate testing. "System upgrades in Nigerian banks often lead to glitches due to unrealistic deadlines set by CEOs aiming to reduce costs," said a senior information security official at a major Nigerian bank. "These tight schedules make it difficult to avoid errors and vulnerabilities, and prolonging the upgrade makes it more expensive for them."

In addition, the pressure to complete system upgrades on time can lead to skipped or shortened testing phases, increasing the likelihood of errors and vulnerabilities. "Whether you are changing software or doing a major update, it is still an upgrade," said Elijah Bello, a Lagos-based software developer and cybersecurity expert. "And usually, banks are under pressure to complete it on time, which may lead the tech team to skip or shorten the testing phase."

The consequences of these glitches can be severe, as they create vulnerabilities that can be exploited by hackers or IT professionals with malicious intentions. "A glitch becomes a gateway for hackers or IT professionals to access accounts or functions they're not supposed to," said Stephen, a Lagos-based mid-management level staff at a major bank. "Nigerian banks face constant cyberattacks from external hackers, disgruntled former IT staff, and individuals with in-depth knowledge of their core software."

The Financial Institutions Training Centre (FITC) reported that fraud-related losses in Nigeria rose to ₦10.1 billion across 19,007 cases in Q3 2024, up from ₦1.18 billion across 12,066 cases in the same period of 2023. The report also noted that 42 employees were terminated due to their involvement in fraudulent activities in Q3 2024, a 14.3% increase from the previous quarter.

Experts recommend that banks improve their hiring and retention strategies for tech talent, strengthen cybersecurity protocols, build redundancy into transaction networks, and improve regulatory oversight of both banks and their third-party partners. "Unfortunately, many of these third-party integrations are poorly done, porous, and create nightmares," said a digital payment expert.

If left unchecked, these glitches could lead to customer attrition, as individuals may migrate to more reliable fintechs or decentralized finance (DeFi) platforms. However, if banks can address these issues, customers may regain faith in digital banking systems, increasing the adoption of digital and mobile banking services.

In a bid to stay competitive, Nigerian banks have increased their technology spending, with six banks collectively spending ₦268.7 billion ($171.5 million) on technology infrastructure in 2024, a surge of 74.5% from ₦153.8 billion ($98.2 million) in 2023. It remains to be seen whether this investment will pay off in terms of improved system security and customer trust.

US government officials reveal that China-backed hacking group Salt Typhoon remains in US telecom networks, sparking concerns over national security and data privacy.

Daniel Supernault, creator of Pixelfed, Loops, and Sup, is raising funds on Kickstarter to further develop his open-source social media apps and support the growing fediverse.

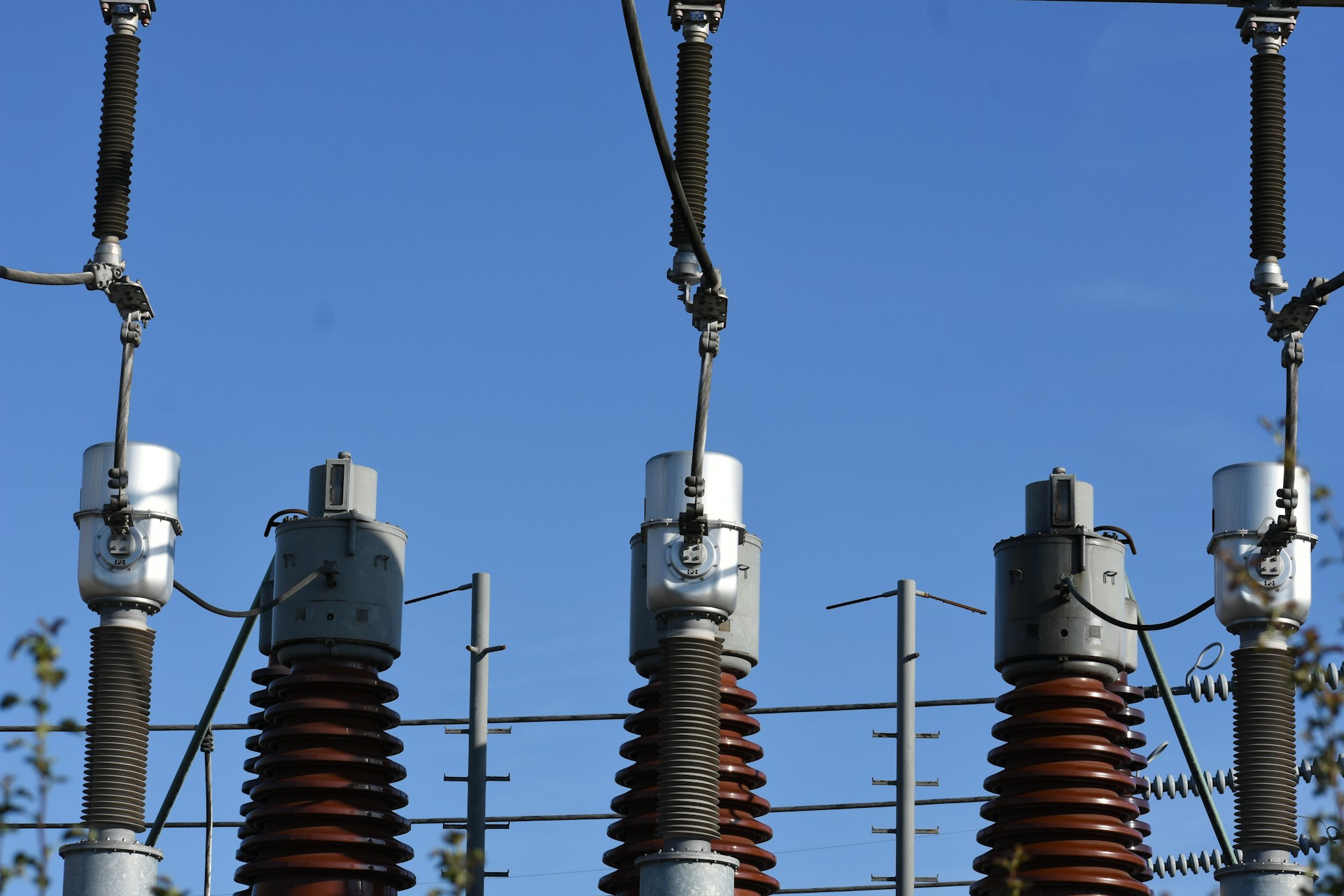

Nigeria's power grid is on the verge of collapse, plagued by frequent system failures, outdated equipment, and inadequate power generation, severely impacting the country's economic growth and the tech and startup community.

Copyright © 2024 Starfolk. All rights reserved.